For years, Citi has sat in the shadows of bigger banks like Chase and American Express. Heck, even Capital One has outpaced Citi with travel credit cards.

But the *citi premier* should really change that narrative. It may not have the same big name or massive marketing budget but it's one of the most well-rounded travel rewards credit cards on the market.

Racking up points with the card is easy, starting with a welcome bonus of 60,000 Citi ThankYou® Points after spending $4,000 in the first three months of card membership. That big bonus, combined with some lucrative and unique ways to use Citi ThankYou points, should officially put the Premier card on your radar if you're in the market for a new travel card.

Beyond the welcome bonus, it's one of the few travel rewards credit cards that offers a category spending bonus at gas stations: Earning 3x ThankYou Points on gas might even help take some of the sting out of higher prices at the pump. You'll also earn 3x ThankYou Points in other common categories such as dining, supermarkets, air travel, and hotels – all for a low $95 annual fee.

Read on for everything you need to know about the Citi Premier card and why it might be a worthy addition to your wallet.

Considering a new card? Be sure to check out our monthly list of the best travel rewards credit card offers!

Citi Premier Card: Benefits Overview

- Welcome Offer: *citi premier bonus*

- Earn 3x Citi ThankYou Points for every dollar spent on air travel and hotels.

- Earn 3x Citi ThankYou Points for every dollar spent at restaurants, supermarkets, and gas stations.

- Earn 10x Citi ThankYou Points for every dollar spent on hotels and car rentals when you book through the Citi Travel portal (through Jun. 30, 2024).

- Earn 1x Citi ThankYou Points for every dollar spent on all other purchases.

- Save $100 annually on a single hotel stay of $500 or more when you book through the Citi Travel portal.

- No foreign transaction fees.

- Annual Fee: $95 (not waived)

Learn more about the *citi premier*.

Citi Premier Card: Benefits Breakdown

Welcome Bonus Offer

New applicants can earn 60,000 Citi ThankYou® Points after spending $4,000 on purchases within the first three months of card membership. But even if you've previously had the Citi Premier Card, you may still be eligible to get the card and earn a bonus again.

In April 2023, Citi changed some policies about card and bonus eligibility across all their cards. The rules now state you must wait 48 months between earning a welcome bonus and applying for the card again.

So if it's been four years since you earned a bonus on the *citi premier*, you may be eligible to earn this 60,000-point bonus again.

We've occasionally seen Citi boost the Premier card's bonus as high as 80,000 points. Still, a 60,000-point bonus is nothing to scoff at.

Annual Hotel Credit

The *citi premier* offers an annual $100 hotel credit every calendar year. It's an ultra-lucrative benefit that instantly outweighs the card's annual fee.

But there's a hitch. This $100 hotel credit is only valid when you book a single hotel reservation of $500 through the Citi Travel portal. You can't just book any hotel stay and automatically save $100.

The upside is that, similar to the Chase Sapphire Preferred's $50 annual hotel credit, it triggers automatically once you make an eligible hotel booking through the Citi Travel Portal.

Put this benefit to use, and it should instantly be enough to justify the card's $95 annual fee. And when you pair it with the card's bonus earning on travel portal bookings, you can actually get a pretty good deal on your hotel stay.

Just be warned that hotel bookings through an online travel agency (OTA), like Citi's travel portal, won't earn hotel points or elite night credits. If you have any sort of elite status, I wouldn't expect the hotel to honor your benefits, either.

Citi Merchant Offers

Want to come out even further ahead on your annual fee? Citi Merchant Offers are money-saving deals for your online shopping, travel, and other purchases.

Just by holding the Citi Premier Card, you'll get access to some of these discounts in categories like shopping, travel, dining, and entertainment. Enroll your card, make an eligible purchase with your Citi Premier Card, and it should automatically trigger the cashback savings.

If you're familiar with the money-saving offers available on American Express cards called Amex Offers, these are practically identical. The list of Citi Merchant Offers isn't quite as extensive as what you'll find from Amex or even Chase, but there are still some good deals to be had.

Annual Fee

The card charges an annual fee of $95 and it is not waived in the first year of card membership.

That fee is inline with the Citi Premier's biggest competitors: the *chase sapphire preferred* and the *capital one venture card*.

No Foreign Transaction Fees

You won't be charged foreign transaction fees when using your Citi Premier Card abroad.

This makes it a solid option to use while traveling out of the country. You'll be rewarded with bonus points for the majority of your travel and dining expenses without paying additional fees.

Citi Premier Card: Earning ThankYou Points

Racking up points with the Citi Premier is quite easy, thanks to the card's useful bonus categories. The average person should have no problem making this one of their most frequently used credit cards.

Cardholders earn 3x points per dollar spent at restaurants, supermarkets, gas stations, air travel, and at hotels on an unlimited amount of spending. That bonus earning makes this card one of the most well-rounded cards when it comes to category bonus spending – especially when you consider the card only has a $95 annual fee.

If you're looking to earn even more points, there's another way. Through Jun. 30, 2024, Citi has added an additional bonus category to the the Citi Premier Card: Cardholders can temporarily also earn 10x ThankYou® Points on hotels and rental cars booked through the Citi Travel® portal. Considering points are worth at least 1 cent each when used for travel, you can look at this like getting a 10% discount on all your hotel and car rental bookings.

You'll also earn an unlimited 1x ThankYou Points per dollar spent on all other purchases.

Citi Premier Card: Redeeming ThankYou Points

A stash of 60,000 ThankYou Points is no small sum – but what exactly can they get you? Or more importantly, how far can they take you?

Let's start simple. Like other major credit card point programs such as Chase Ultimate Rewards, American Express Membership Rewards, and Capital One Venture Miles, you can redeem your Citi ThankYou points for gift cards at a bunch of popular merchants. You can redeem also them for travel through the Citi Travel portal – with each point worth 1 cent apiece. This means that at a bare minimum, the 60,000-point bonus on the Citi Premier Card is worth $600 in travel.

But you can do much better by transferring points to travel partners. Citi has a stable of nearly 20 different airline and hotel transfer partners. And ThankYou points transfer to all of them on a 1:1 basis (with the exception of Choice Hotels which transfers on an even better 1:2 basis). That mean 60,000 Citi points can net you 60,000 airline miles or 120,000 Choice points.

Here's the full list of Citi transfer partners.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aeromexico | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| Avianca LifeMiles | Airline | 1:1 | Instant |

| Cathay Pacific | Airline | 1:1 | 12-24 hours |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Instant |

| EVA Air | Airline | 1:1 | 1-3 days |

| JetBlue | Airline | 1:1* | Instant |

| Qantas | Airline | 1:1 | 1-2 days |

| Qatar Airways | Airline | 1:1 | 1-2 days |

| Singapore | Airline | 1:1 | 12-48 hours |

| Thai Airways | Airline | 1:1 | 4-7 days |

| Turkish Airlines | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

| Accor | Hotel | 2:1 | TBD |

| Choice Hotels | Hotel | 1:2* | Instant |

| Wyndham Rewards | Hotel | 1:1* | Instant |

| The Leading Hotels of the World (LHW) | Hotel | 1:0.2 | TBD |

Citi has quite the mixed bag of transfer partners. We've traditionally considered ThankYou points the clear loser behind both Chase Ultimate Rewards, Amex Membership Rewards, and even Capital One Venture Miles – but that might be a little harsh. There's plenty of value with transfer partners like Turkish Miles & Smiles, Cathay Pacific's Asia Miles, Virgin Atlantic Flying Club, Singapore Airlines, and Air France/KLM Flying Blue.

But there are some gaps where Citi falls short. Most importantly, you can't transfer these points to one of the big three U.S. airlines: Amex has Delta and Chase has United. Unfortunately, you cannot transfer Citi points to American Airlines, even though Citi offers many co-branded American credit cards.

But that shouldn't mean you write off earning these points – far from it.

Transferring ThankYou Points to Virgin Atlantic in order to book short Delta flights can be a great way to use your 60,000-point bonus. In fact, you'll almost always score a better deal by booking Delta flights with Virgin Atlantic's Flying Club instead of using your Sky Miles. That's true whether you're looking to stay in the U.S. or fly Delta's swanky Delta One Suites business class across the pond to Europe for 50,000 points.

Above all else, there are some great niche uses for ThankYou Points that you won't find with other points programs. Qatar miles are a great way to book fantastic Qsuites business class. And best of all, Qatar charges a reasonable 70,000 miles and $100 or so for a one-way flight from the U.S. to the Middle East.

Read more: The Master Guide to Booking Qatar Airways Flights Using Qatar Avios

But perhaps the best option here is Turkish Miles & Smiles, as Citi is one of the few ways to earn these miles. Using Turkish miles, you can book roundtrip flights from the mainland all the way to Hawaii for just 15,000 miles roundtrip – or 25,000 miles in business class. Booking these flights is a convoluted process, as you'll need to find the award availability and likely either call or email Turkish to book. But at that price, it's worth the work.

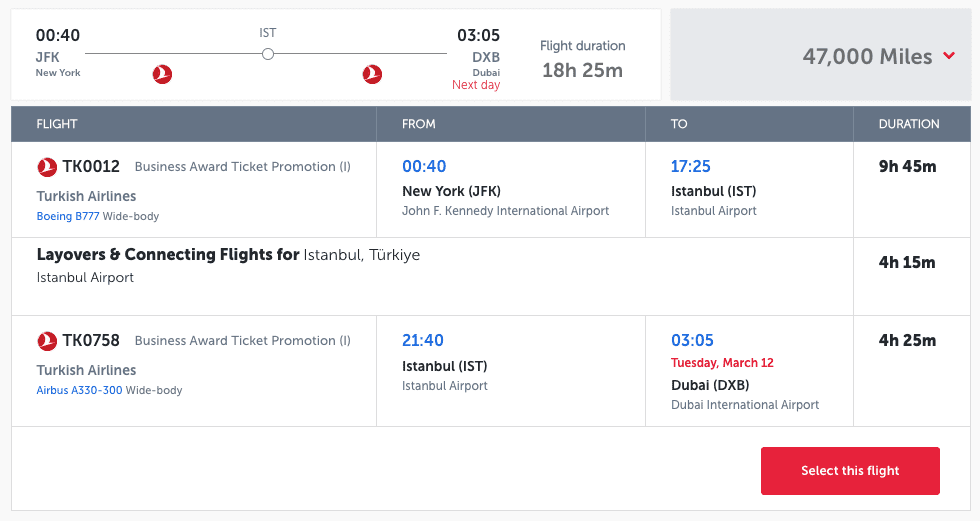

Turkish also charges just 45,000 miles for one-way business class flights from the U.S. to Europe on Star Alliance carriers like United, Swiss, and (of course) Turkish itself. That's tough to beat.

Read our full review of Turkish Airlines business class on the 787!

Or you could continue on to a city like Dubai (DXB) and stay at the luxurious Park Hyatt Dubai. At a price of just 47,000 miles for the one-way business class ticket all the way from the U.S. to Dubai, you won't find a cheaper ride to the middle-east.

These are, of course, just a few of the great ways to use Citi ThankYou points. Just because they don't have a domestic transfer partner like Chase does with United and Amex does with Delta, doesn't mean that you should burn them all on gift cards. There are still tons of valuable ways to use Citi ThankYou Points.

Make sure to check out our post on the best ways to use Citi points.

Citi Premier Card: Are You Eligible for the 60K Bonus Offer?

Citi can be a bit finicky with their card approvals … like denying applicants for having too low of a credit utilization (i.e. not carrying a balance). And while they don't have the same strict requirements as other banks like Chase – there are still some rules that you need to be aware of if you're considering applying for this card.

Critically, if you've received a welcome bonus on the Citi Premier in the past 48 months, you will not be eligible to earn the new account bonus at this time. Also, Citi will only approve you for one card every eight days – and two cards in a 65-day window. If you have previously applied and been approved for multiple Citi cards within that time period, you will not be eligible.

Above all, keep in mind: Credit cards are serious business. As tantalizing as a 60,000-point bonus may be, it's not worth digging yourself into debt over. If you can't responsibly spend $4,000 over the next three months and pay the card's balance in full each statement cycle, this offer simply isn't worth going after.

Related reading: Master Guide to Credit Card Application Rules

Bottom Line

When it comes to earning points, the Citi Premier Card truly shines by offering a solid welcome offer and useful category bonuses. In fact, you'll be hard-pressed to find a more well-rounded card with bonus categories aligned to the average person's biggest monthly expenses – supermarkets, restaurants, gas stations, air travel, and hotels.

Just because Citi gets overshadowed by banks like Chase and American Express doesn't mean you too should look past them. Considering all the Citi Premier Card offers, it might just be a diamond in the rough.

Learn more about the *citi premier*.

I applied for this card to take advantage of the 80000 points and transfer them to American. . I have completed that although it was not easy since they give you such a low starting credit line. I was about to take advantage of the transfer until I read the reports of American soon to be devaluing it’sAdvantage offers. Am I better off waiting and keeping the miles in Citi?

Hi Barbara. I would never recommend transferring miles out of a flexible points program like Citi ThankYou until you are ready to redeem them. If you have a specific use for them with AA, it can make sense now. Otherwise, I would keep them with Citi for the time being.

Is there any expiration for these City Thank You miles ?

The miles will be valid as long as your card is open. No expiration date beyond that.

“Citi has a stable of 18 different airline and hotel transfer partners. ThankYou points transfer to all of them on a 1:1 basis”-

And then go on to list choice as a 1:2 ratio. You may want to edit this

Thanks, Jason. That has been corrected. Choice is a new partner with Citi so that was an oversite.

Any idea how quickly these cards arrive after approval?

Generally speaking, within 5 to 7 business days.

Can my points be sent to my wifes card to combine points?

You can, but there is a catch.

Once the points are transferred between two ThankYou accounts, they will expire in 90 days and there is nothing you can do to extend the expiration date. That means you should only transfer the points if you are ready to redeem them. If transferred points sit for 90 days, they will be forfeited.

Wow thanks for the info!

I recently transferred chase points to my wife’s account. I hope they don’t have a similar policy. Can you confirm?

Of course. Chase doesn’t have any sort of restrictions. Here is our master guide which breaks down the rules for each bank:

https://thriftytraveler.com/guides/points/points-principles-transfer-credit-card-points/