If you have a credit card like the *chase sapphire preferred* or the *chase sapphire reserve*, it's possible to keep earning valuable Chase Ultimate Rewards points through some of Chase's no annual fee, cashback cards.

How so?

Well, even though Chase markets cards like the *freedom unlimited* and the Chase Freedom Flex℠ as cashback cards, that cash back is actually awarded in the form of points that can be redeemed for cash … among other things. This means that so long as you have one of those other Chase Ultimate Rewards-earning cards like the Sapphire Preferred or the *chase ink preferred*, you have far more options for redeeming your points.

The same is true for cashback-earning business cards like the *chase ink cash* or the *chase ink unlimited*.

Lucky for you, combining and redeeming points between your Chase credit cards is easy. Here's what you need to know.

Related reading: Have a Chase Sapphire Card? Here's What To Do Next

Why Would I Transfer My Chase Points Between Cards?

There are a few reasons you'd want to transfer your Ultimate Rewards points between cards.

- You have a cashback card like the Chase Freedom Unlimited or Chase Freedom Flex, or a business cash back card like the Chase Ink Cash or the Chase Ink Unlimited and would rather have Ultimate Rewards points you can use for travel than cash back from spending on that card.

- You want to strategize the use of your different Chase cards' earning categories. Some of the cashback cards earn more points in certain spending categories than travel rewards cards which can then be transferred into Chase Ultimate Rewards points.

- You're closing a card and have points remaining on that card (but have another Chase card to transfer to).

Related reading: What Happens to Your Points & Miles When You Cancel a Card

How to Transfer Points Between Chase Cards

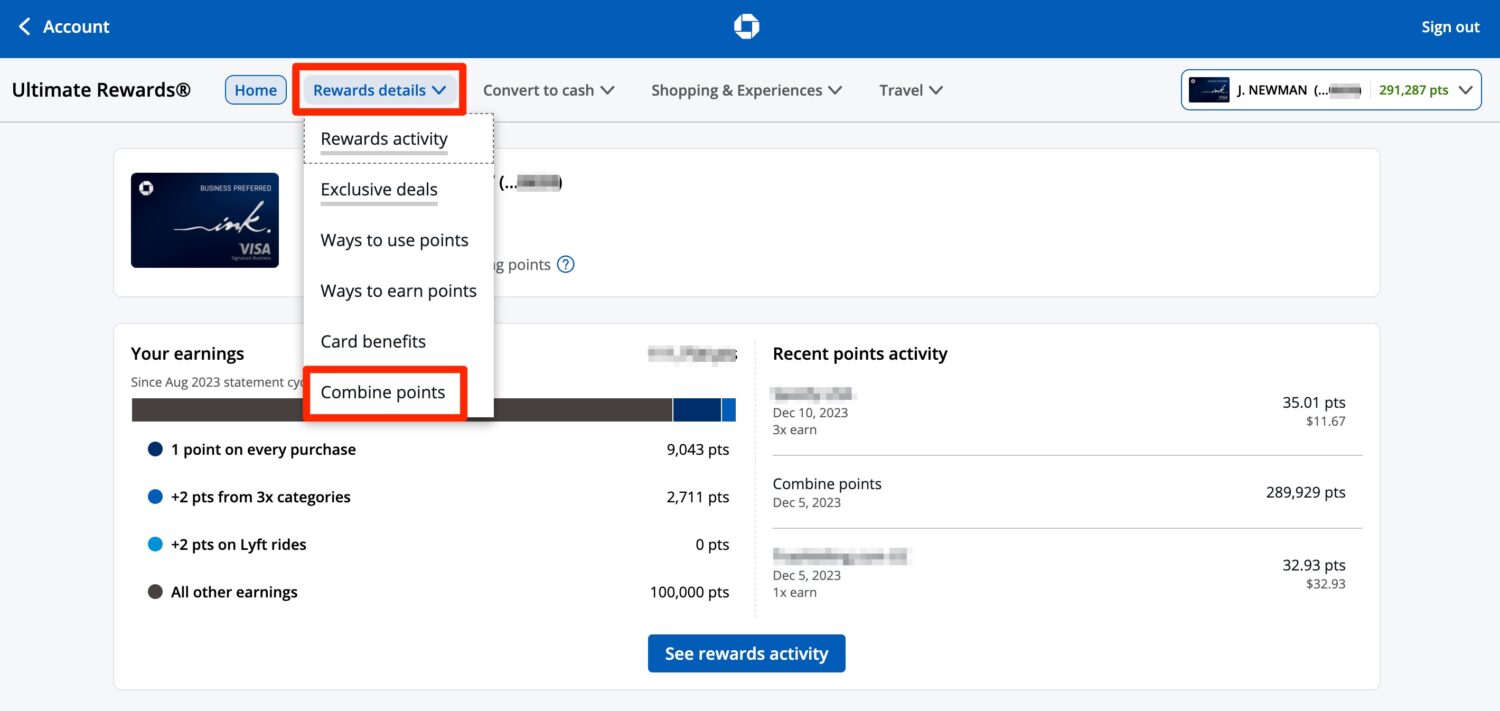

First things first, you need to log in to the Chase Ultimate Rewards portal where you'll see this menu bar of different options at the top. To get started, click “Rewards details” and select the “Combine Points” option.

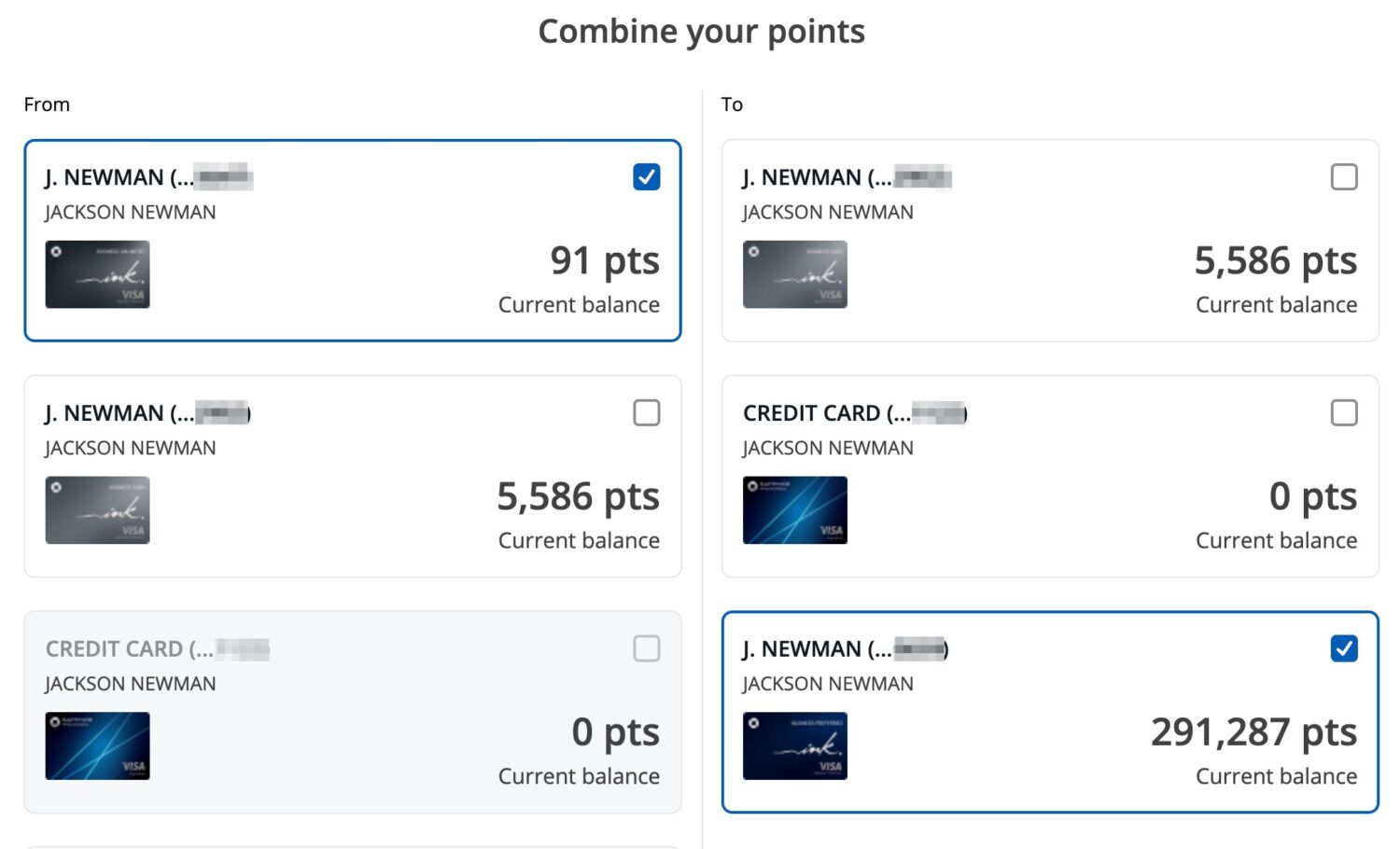

After clicking on “Combine Points”, you'll choose which cards you'd like to move points from and to.

I recently picked up the *chase ink preferred*, and since I already had the *chase ink unlimited*, I can send the points earned from my Ink Unlimited Card to my new Ink Preferred. This ultimately makes those points more valuable by allowing me access to Chase's stable of transfer partners – and also gets me 1.25 cents each in value when using them through the Chase Travel Portal.

Related Reading: How to Combine Chase Points with Another Cardmember

All I need to do is select the card I want to move points to and from. Since I combined my personal and business accounts into a single login, you'll see all my Ultimate Rewards earning cards listed here.

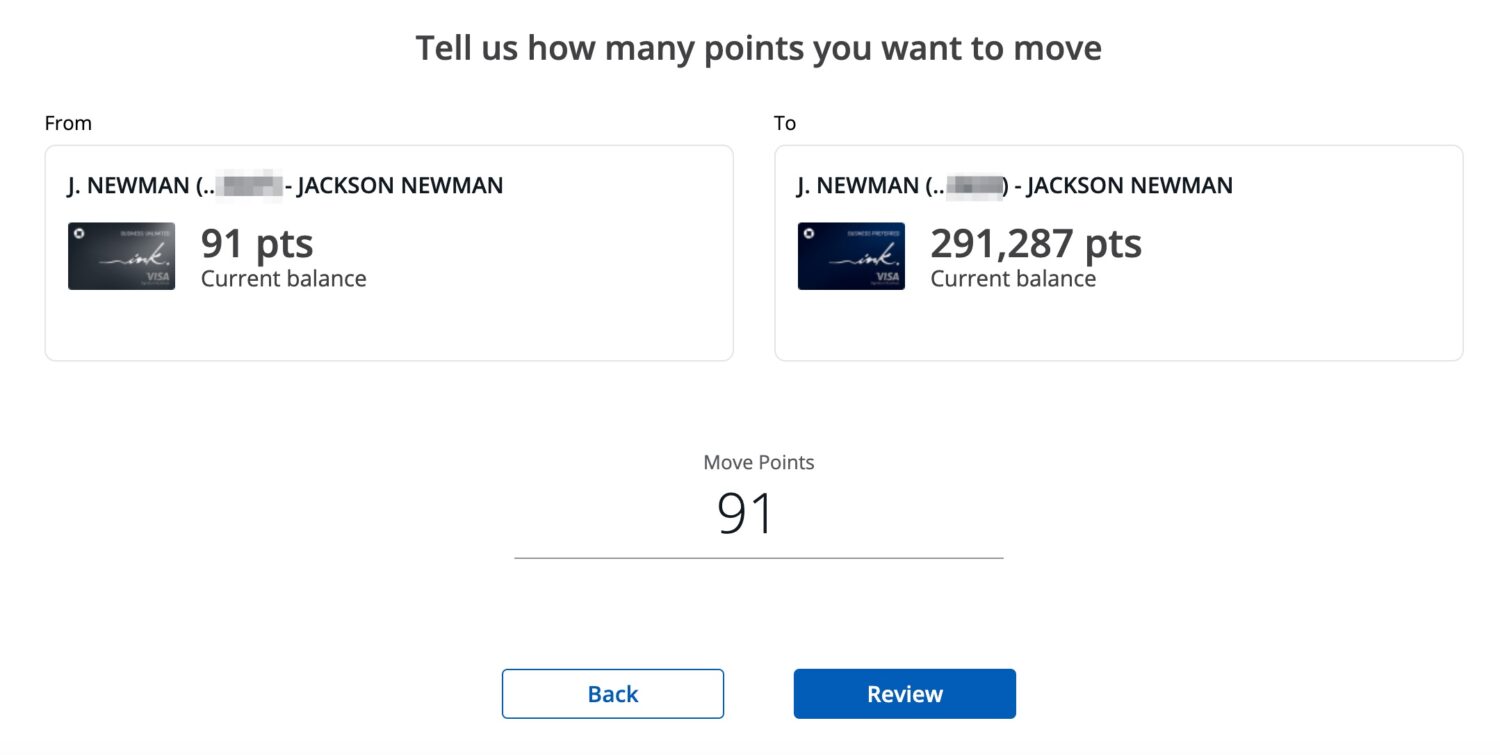

On the next screen, you'll select how many points you'd like to move. You can move points in any denomination of your choosing. In my case, I'm electing to transfer a whopping 91 points from my Ink Unlimited Card to my Chase Ink Preferred Card.

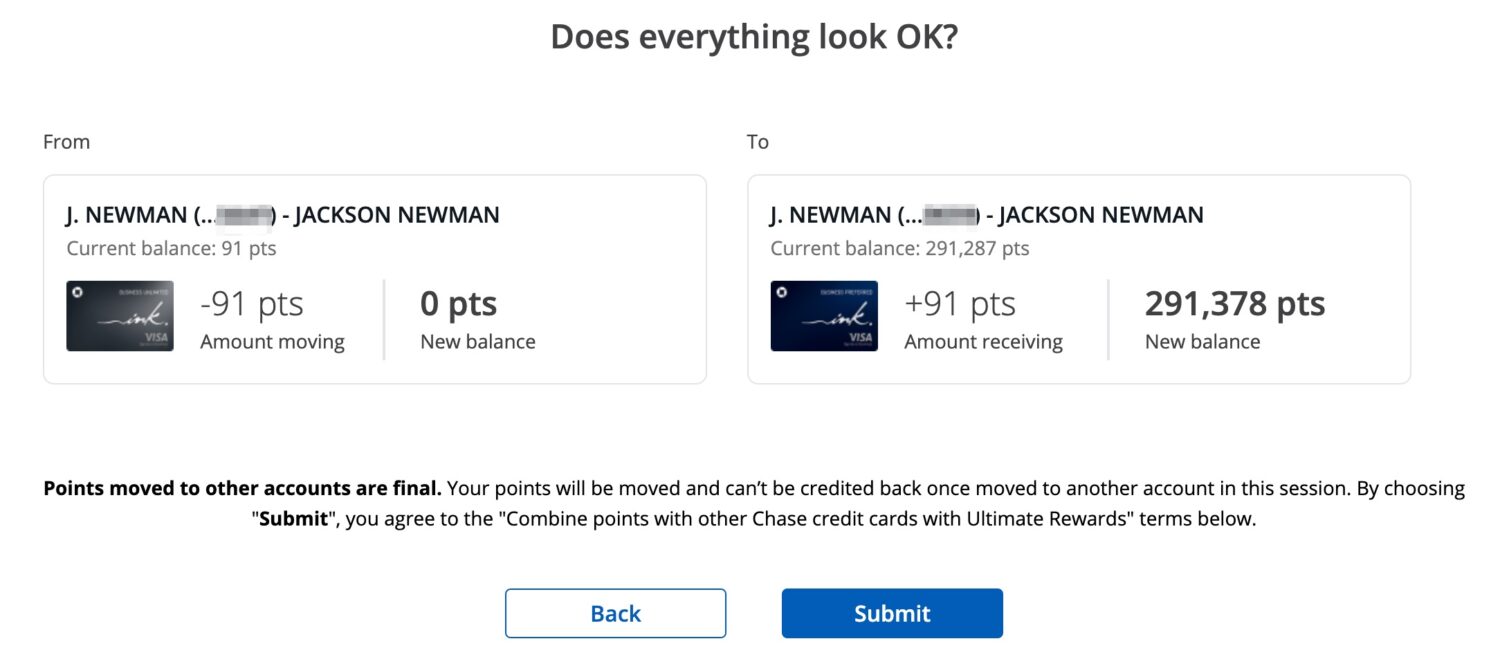

Finally, you'll get to a screen to review the details of your points transfer. Chase provides details on the left-hand side of the points move. Simply hit “Submit” to move your points.

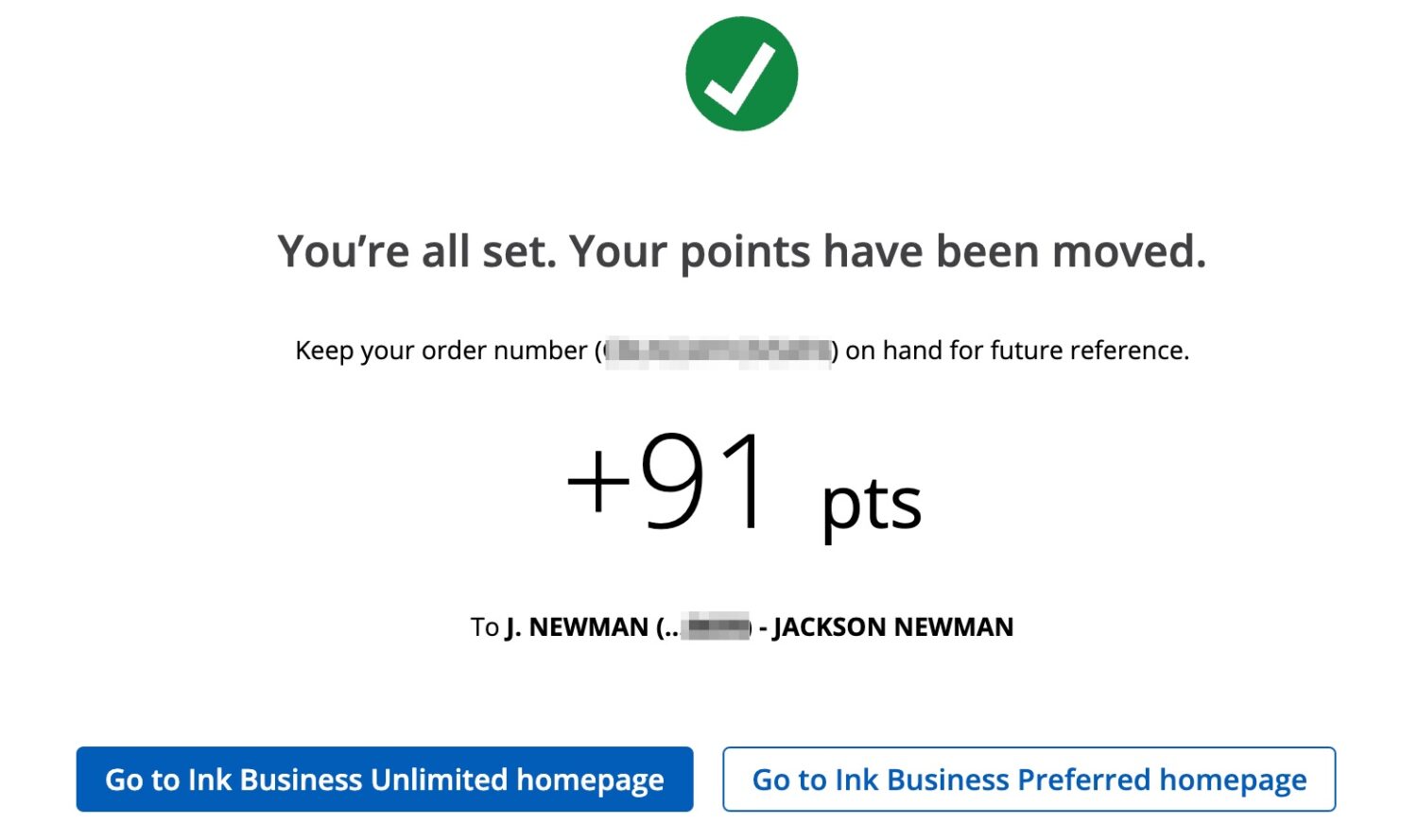

That's it! Once you hit “Submit” you'll get to a confirmation screen that shows your Chase points have been transferred to another card. Most importantly, the points will be immediately available for use.

Why You Should Consider Chase's Cash Back Cards

You’ve earned the big bonus on your Sapphire Preferred or Sapphire Reserve card and keep turning to that card to earn more points. That may make sense in some scenarios, but the best way to keep adding to your stash of Chase points might be with other Chase cards.

Take a good, hard look at either the Chase Freedom Flex℠ or the *freedom unlimited* cards. They form a perfect tandem with the Sapphire cards – and best of all, neither has an annual fee.

While Chase markets both of these cards as cashback credit cards, they get exponentially more valuable if you hold either (or both) of them with a Chase Sapphire card. That’s because as outlined above, you can transfer the cashback earned from either card directly into your Chase Ultimate Rewards account, turning that cashback straight into Chase points. If you earn $100 of cashback, that becomes 10,000 Chase Ultimate Rewards points, which could be redeemed for at least $125 worth of travel depending on the card – or potentially more if you transfer them to an airline or hotel partner.

Most importantly, these cards are more lucrative for some of your everyday expenses rather than simply continuing to swipe your Preferred or Reserve card. Especially right now if you're able to get in on the Freedom Unlimited's intro offer of an extra 1.5% cash back on all purchases (up to $20,000) for the first year!

This essentially makes the Freedom Unlimited a 3% cash back card for all purchases (up to $20,000) in your first year of card membership – and you can do even better when spending in one of the card's bonus categories.

Let’s take a look below at the benefits offered by each of the Freedom cards.

Read more: Chase Freedom Flex vs Freedom Unlimited – Which Card is Right for You?

Chase Freedom Unlimited

- Intro Offer: Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back.

- Earn 5% cashback on travel booked through the Chase Ultimate Rewards portal.

- Earn 5% cashback on Lyft rides through March 2025.

- Earn 3% cashback on dining

- Earn 3% cashback at drugstores

- Earn an unlimited 1.5% cashback on all other purchases.

- No Annual Fee!

Learn more about the *freedom unlimited*.

Chase Freedom Flex

- Welcome Offer Bonus: Earn a $200 bonus after spending $500 in the first three months of card membership.

- Earn 5% cashback on rotating quarterly categories on up to $1,500 of spending which could include:

- Grocery stores, gym memberships, streaming services, gas stations, etc – see our guide of the rotating Chase Freedom bonus categories.

- Earn 5% cashback on travel booked through the Chase Ultimate Rewards portal

- Earn 3% cashback on dining, including takeout and delivery services

- Earn 3% cashback at drugstores

Learn more about the Chase Freedom Flex. (for full disclosure, this is our personal referral link).

Have a Business? Look at Chase Ink Business Cards

Small business owners (and trust me, you may be eligible for a business credit card without realizing it) who already have a card that earns Chase Ultimate Rewards points like the *chase sapphire preferred* or even the *chase sapphire reserve* can keep earning points with the suite of Chase Ink Business credit cards. In fact, it’s easier than ever.

Two of the Ink business credit cards – the *chase ink unlimited* and the *chase ink cash* – are worth a serious look.

No matter which version of the card you choose, you can earn $750 cash back after spending $6,000 in the first three months of card membership.

As long as you hold a card that already earns Ultimate Rewards points, this $750 cash back can instantly become 75,000 transferable Chase Ultimate Rewards points to use towards travel.

Not sure which one to pick? Chase doesn’t restrict you from having both, so that’s an option. And while they offer some of the same benefits, there are other key differences between the Ink Cash vs. the Ink Unlimited cards you should be aware of.

Read More: Chase Ink Cash vs Ink Unlimited, Which Offers the Best Return For Your Business?

Chase Ink Business Cash Credit Card

- $750 cash back (or 75,000 points) after spending $6,000 in the first three months of card membership.

- The card has no annual fee

- 5x points (5% cash back) on internet, cable, and phone service; office supply purchases on your first $25,000 of spending each year.

- 2x points (2% cash back) on restaurants and gas stations on your first $25,000 of spending each year.

- 1x points (1% cash back) on all other eligible spending

- Primary rental car collision and damage waiver coverage

- Lost luggage insurance of up to $3,000 per person per trip

- Add employee cards at no additional cost

Learn more about the *chase ink cash*.

Chase Ink Business Unlimited Credit Card

- $750 cash back (or 75,000 points) after spending $6,000 in the first three months of card membership.

- The card has no annual fee

- 1.5x points (1.5% cash back) on all purchases

- Primary rental car collision and damage waiver coverage

- Lost luggage insurance of up to $3,000 per person per trip

- Add employee cards at no additional cost

Learn more about the *chase ink unlimited*.

As you can see, whether you hold a Freedom Card, an Ink Card, or both, they can help you earn more points than you would with a Sapphire Card alone. And thanks to how easy Chase makes it to pool those points into one account, it's a great option to maximize your spending with Chase credit cards.

Bottom Line

Whether you're closing a credit card or looking to optimize your Ultimate Rewards points, Chase makes it easy to transfer points between all your Chase Ultimate Rewards accounts.

I have quite a few credit cards but always pay the balances in full every month (before the due date) and have an excellent credit rating.

When I applied for another Chase CC a couple of months ago I was denied.

Is it possibly because I’m now retired and not earning as much?