Points and miles, miles and points. They seem synonymous, right?

Wrong. There are some key differences between airline miles and credit card points. And chief among them is the ability to earn miles on the flights you book.

You won't keep earning miles when using airline miles like Delta SkyMiles or American AAdvantage miles to book free flights. But it can be a different story with flexible points like Chase Ultimate Rewards, American Express Membership Rewards, and Capital One Venture miles.

Not only can you fly for free with these points – you can keep earning miles while doing it.

Why You Earn Miles on Flexible Points Award Bookings

When you book award flights directly with an airline using their miles, you won't earn miles for actually flying. In the airline's eyes, because you're using miles you earned, you can't earn them more at the same time. Makes sense, right?

With credit card points, it's different. You have options.

In many cases, you can turn these points into miles by transferring them to different airline partners. And once you send them to partner, they're airline miles – the same rules apply. But credit card points also give you the ability to book travel directly.

When you book a flight through the Chase Ultimate Rewards portal or through Amex, your points act like cash, where each point is worth 1 cent (or more) toward your airfare. But in the eyes of the airline, your ticket is just like any fare you bought with cash. You're trading in your points to Chase (or Amex or Capital One), and Chase turns around and pays for your flight.

It's a simpler way to book, with some major advantages over the traditional airline award booking – especially when cash flights are cheap. And so long as you enter your frequent flyer number, you'll still earn miles on the airline you're flying.

Not familiar with booking a cash flight with points using flexible points like Chase or Amex? Check out our full guide. While you can sometimes get more value out of your points by transferring them, this is a no-nonsense way to book some free travel.

How it Works

Simply put, you book a cash flight but pay with your points.

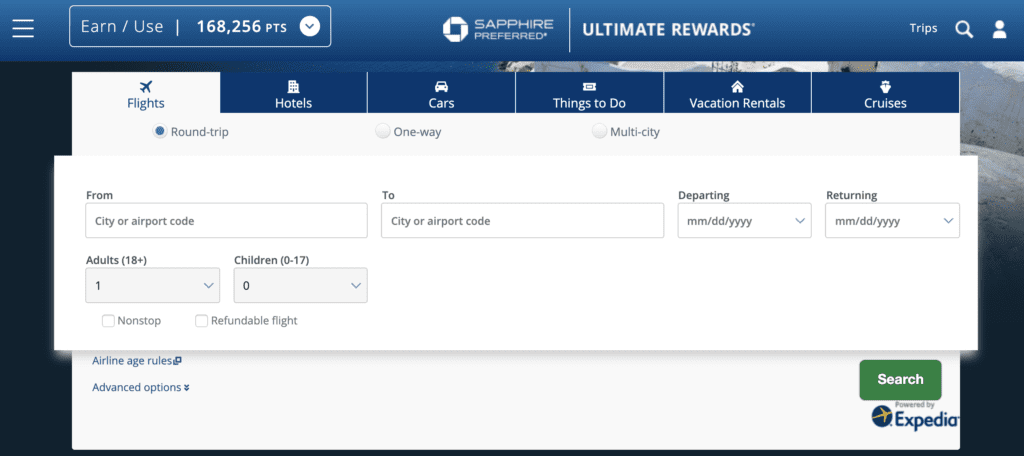

For example, just log into the Chase Ultimate Rewards portal and search for a flight like you normally would. The best way to do this is to find the cheap flight first – either through our Thrifty Traveler Premium flight deal notifications or by searching yourself on Google Flights. Then find your flight in the travel rewards portal.

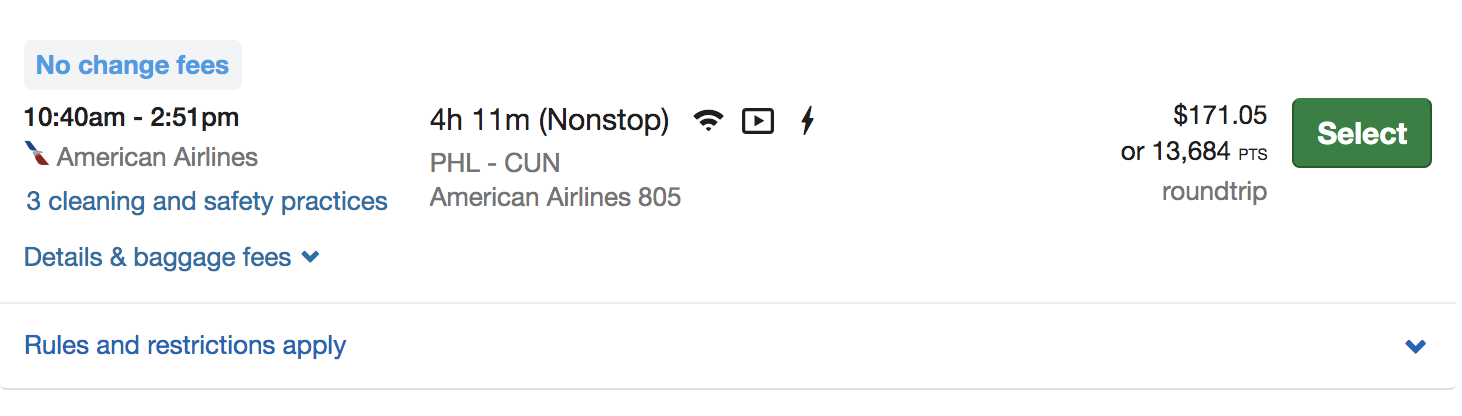

The search will come back with your best options, listed in both cash price and points cost. When a deal is cheap, it can be a great time to use those flexible points to cover the cost! For example, Thrifty Traveler Premium recently got a deal for hundreds off flights to Cancun (CUN), including flights from Philadelphia (PHL) to Cancun (CUN) for $172.

But with the Chase Sapphire Preferred Card, you could book that same fare for less than 13,700 Chase points. That's half of what most airlines charge in miles. And your points cover all the taxes and fees, too. It's one of the best ways to book these flights, period.

It gets even better with the Chase Sapphire Reserve. Because those points are worth more toward travel, you could book the exact same flight for just over 11,400 points.

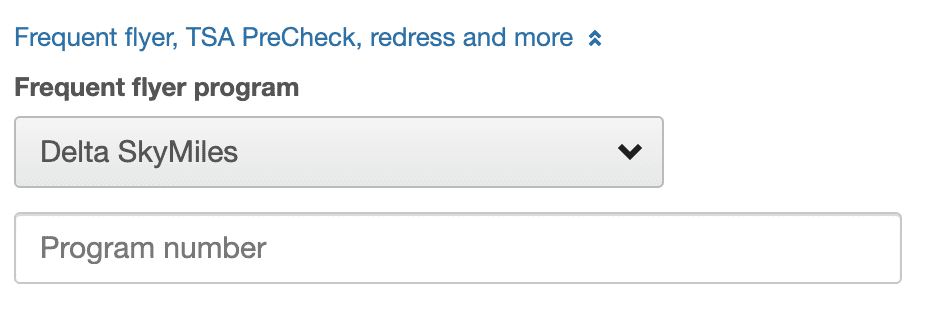

Once you've selected the flight you'd like to redeem your points for, you'll fill out your personal and travel information. This includes providing your frequent flyer program number for the airline you'll be flying. Be sure to add this so you earn miles for your flight!

And it's as simple as that. Book your flight for free using flexible points, and still earn miles for flying on that airline. That's a win-win.

How to Earn These Flexible Points

The three top flexible points programs are Chase Ultimate Rewards and Amex Membership Rewards, and Capital One Venture miles. But one stands above the rest: Chase.

To earn Chase points, we recommend starting out with either the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

Each point is worth 1.25 cents toward travel with the Sapphire Preferred, so you could book $750 in flights with 60,000 points for example. The card also comes with a mix of benefits like travel insurance, rental car coverage, and no foreign transaction fees. All that for a low annual fee of $95.

Click Here to get more information about the Chase Sapphire Preferred Card.

The Chase Sapphire Reserve has become the gold standard in the points and miles world. Perks like lounge access, unbeatable travel insurance coverage, and bigtime travel credits make this card very popular, despite its relatively high annual fee of $550.

And when it comes to booking flights with points, it doesn't get any better: Each point with the Chase Sapphire Reserve is worth 1.5 cents. That means you could book $500 in flights for just 33,333 Chase points.

Click Here to get more information about the Chase Sapphire Reserve.

Bottom Line

Yes, you can actually still earn miles for flying on a ticket booked with points. Use your credit card points to book a cash flight for free, toss your frequent flyer number into the reservation, and keep earning toward your next trip.

What if you book through Chase and just pay cash? Will you still earn miles on Delta? This was super helpful!

Hey Matt, you sure will. Hotels are a different story, but airlines will still earn miles with the carrier you are flying.