For millions of Americans across the U.S., paying rent is by far their biggest monthly expense, and it isn't particularly close. But for the size it eats up of Americans' budget, there hasn't been an easy way to earn points and miles on your rent payments – at least not without paying hefty surcharges. But that's changing.

This week, a New York City-based startup named Bilt launched the first-ever rewards program (and corresponding credit card) that lets you earn points on your rent payments without paying transaction fees.

Read on for everything you need to know about the exciting new Bilt Rewards program, a first of its kind for renters.

What is Bilt Rewards?

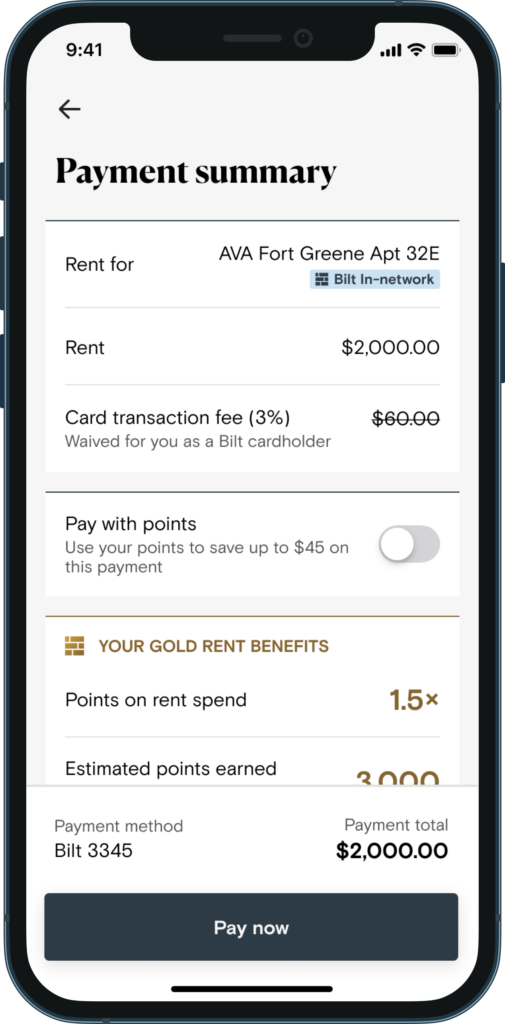

Bilt Rewards is a brand new rewards program that allows qualified U.S. renters the ability to earn rewards by paying their rent through the Bilt Rewards app. When you pay your rent with Bilt, you'll get 1 point for every dollar spent on rent each month, up to 100,000 points per calendar year.

At launch, you'll need to be renting from a property management group in the Bilt Rewards Alliance. If your landlord is a member of the Bilt Rewards Alliance, you will be able to pay your rent electronically through the Bilt Rewards app by securely linking your bank account. According to Bilt, the current members of the Bilt Alliance make up more than 2 million rental units.

Bilt Rewards Alliance Members

- The Blackstone Group

- The Related Companies

- Equity Residential

- GID

- AvalonBay Communities, Inc.

- Camden Property Trust

- Cushman & Wakefield

- Trammell Crow Residential

- Highmark Residential

- AMLI Residential

- Morgan Properties

- SL Green Realty Corp.

- Starwood Capital Group

- LivCor

- The Moinian Group

- Veritas Investments

- Artemis Real Estate Partners

Tenants that rent from one of these alliance members will reportedly get priority when Bilt eventually launches.

Renting someplace that doesn't make this list? By paying your rent through Bilt, the company can send your landlord a paper check via USPS First Class mail for your rental amount. Bilt says it will take five to seven days to process.

Bilt Rewards Card Overview

Here is what you need to know about the Bilt Rewards Mastercard:

- 3x points per dollar spent on dining

- 2x points per dollar spent on travel

- 1x points per dollar spent on other purchases

- 1x points per dollar spent on rent in the Bilt Rewards app (up to $100,000 per calendar year)

- Earn double points on Rent Day (the 1st of the month), up to 10,000 bonus points per month

- 6x points per dollar spent on dining

- 4x points per dollar spent on travel

- 2x points per dollar spent on everyday purchases

- 1x points per dollar spent on rent

- Trip cancellation, interruption, and delay protection

- Trip delay reimbursement

- Auto rental collision damage waiver

- Cellular telephone insurance

- No foreign transaction fees

- No annual fee!

Learn more about the *bilt rewards card*.

It's important to note that in order to earn points for rent and purchases made with your Bilt Card, you need to make a minimum of five purchases each statement period. With this requirement, Bilt is encouraging you to keep their card at the top of your wallet and make it your go-to card for all your purchases. With the ability to earn additional points on dining and travel, that should be reason enough to make it an everyday contender for many folks.

For more information on Bilt Rent Day, check out some of the fun promotions they've run in the past!

Does the Bilt Card Have a Sign-Up Bonus?

On paper, the Bilt Card doesn't come with a sign-up bonus. What you get is a solid no-annual fee travel rewards credit card with perks and point earning more often seen on cards with annual fees in the $100 range.

But unofficially, the Bilt Card does come with a bonus offer that allows you to earn extra points during your first five days with the card. Again, the keyword here is unofficial, meaning there's a chance you won't get this offer when your card arrives. However, we've heard from enough people now that it seems you're more likely to get it than not.

Everyone who's reported getting the offer has received the same one: Earn 5x points on all your purchases (excluding rent) for the next five days. Bonus point earning is limited to 50,000 bonus points which means the maximum amount you could spend at 5x is $12,500 in the first five days.

If that math sounds off, it's not … but I don't blame you for thinking so. With this introductory promo offer you'll earn 1x base points and 4x bonus points on all purchases. Since the offer limits you to earning a maximum of 50,000 bonus points, you'll be able to spend up to $12,500 at 5x and walk away with more than 60,000 Bilt points in the process.

Timing your Bilt Rewards Card application with a big purchase like a quarterly tax payment, home remodel, or furniture purchase can be a great way to quickly earn a meaningful amount of Bilt points and unofficially earn a sign-up bonus in the process.

For more ideas on how to max out this bonus, read our guide to hitting your minimum spending requirement responsibly!

Earning Bilt Points on Rent

Earning points with Bilt Rewards is relatively straightforward and simple.

Program members will earn a minimum of 250 Bilt Points per month by paying their rent through the Bilt Rewards app, no matter how much your monthly rent costs. Simply pay through the Bilt app and you'll receive 250 points each and every month.

But you can accelerate your earnings with the Bilt Rewards Mastercard – though doing so will make things a little more complicated.

How to Use Bilt Rewards Points

Just because Bilt points can be fairly difficult to earn, doesn't mean they aren't useful – just the opposite. There are many ways to use Bilt points. And once you've got them, they're some of the most valuable points in the world of travel.

Use Them for Travel

The easiest way to use them is to book through the Bilt Rewards travel portal, where each point will be worth 1.25 cents apiece. That means 10,000 Bilt points are worth $125 toward travel.

But you'll get the best value for your points by transferring to one of Bilt's 14 travel partners, including World of Hyatt, American Airlines, Turkish Airlines Miles & Smiles, United Mileage Plus, and British Airways Avios, among many others. And your points can go even further by taking advantage of Bilt's frequent Rent Day transfer bonuses.

Here's the full list of Bilt transfer partners:

| Program | Type | Transfer Ratio |

|---|---|---|

| Aer Lingus Avios | Airline | 1:1 |

| Air France/KLM Flying Blue | Airline | 1:1 |

| Air Canada Aeroplan | Airline | 1:1 |

| American Airlines AAdvantage | Airline | 1:1 |

| Avianca LifeMiles | Airline | 1:1 |

| British Airways Avios | Airline | 1:1 |

| Cathay Pacific Asia Miles | Airline | 1:1 |

| Emirates Skywards | Airline | 1:1 |

| Hawaiian Airlines HawaiianMiles | Airline | 1:1 |

| Iberia Avios | Airline | 1:1 |

| Turkish Miles & Smiles | Airline | 1:1 |

| United MileagePlus | Airline | 1:1 |

| Virgin Atlantic Flying Club | Airline | 1:1 |

| World of Hyatt | Hotel | 1:1 |

| IHG Hotels | Hotel | 1:1 |

| Marriott Bonvoy | Hotel | 1:1 |

If you prefer to use your points for something other than travel, Bilt recently introduced the ability to “cash out” Bilt Rewards points (at a rate of .55 cents per point) by applying them as a statement credit to the outstanding balance on your Bilt Rewards Card. At approximately a half cent per point, redeeming them this way represents poor value and should really only be done as a last resort.

Read more: Earn up to 11x Bilt Points at Select Restaurants With Bilt Dining

Get a Rent Discount or Build a Future Down Payment

One of the most unique ways to use your Bilt Rewards points is to cover the cost of your rent payment – or even put it towards a future downpayment on a house.

If you rent from a landlord in the Bilt Rewards Alliance, you'll have the option to use the points you earn to cover future rent payments. Exactly how much those points will get you toward your rent payment is unclear – all we know is that redemption rates will vary by partner.

If you use the points to cover the cost of a future down payment, each point will be worth 1.5 cents.

Other Ways to Use Bilt Points

If you prefer to use your points for something other than travel or a downpayment on a new house, Bilt recently introduced the ability to “cash out” Bilt Rewards points (at a rate of .55 cents per point) by applying them as a statement credit to the outstanding balance on your Bilt Rewards Card. At approximately a half-cent per point, redeeming them this way represents poor value and should really only be done as a last resort.

You can also use your points to pay for a purchase directly through Amazon. When you use points at Amazon, you're only getting 70 cents on the dollar: 100 Bilt points is equal to $.70 worth of stuff. That's also a pretty poor redemption and one that most people shouldn't consider.

Lastly, there is the Bilt Collection: A curated collection of artwork, home decor, tech & lifestyle products where you can redeem your points for free stuff.

Our Analysis

This is clearly an exciting new development in the world of transferable points. It's the first service of its kind, opening up a new avenue to earn points and miles on an expense where that historically hasn't been possible. And that's all without paying any transaction fees for money you are already spending.

Even if you don't rent from a current member of the Bilt Rewards alliance, it is still a great opportunity to earn points for one of life's biggest monthly expenses. Those points can be transferred to awesome travel partners like American AAdvantage miles or World of Hyatt. Or you can even use them to cover rent or a future downpayment on a house.

Bilt deserves huge kudos for rolling out a completely novel service that allows tenants to earn rewards points on rent payments, all without paying a transaction fee.

Bottom Line

Bilt Rewards is a great new service to earn transferable rewards points on your monthly rent payment. Renters and non-renters alike can earn even more Bilt points by adding the *bilt rewards card* to their wallet.

Learn more about the *bilt rewards card*.

Images courtesy of Bilt