As travel ground to a halt back in 2020, Chase rolled out a new way to use points on both the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve®. But even as travel bounces back, that option is still around: It's called Chase Pay Yourself Back.

Chase's Pay Yourself Back benefit allows cardholders to use their Chase Ultimate Rewards points towards other, nontraditional expenses in categories that occasionally change.

Historically, your Chase points were worth the same using Pay Yourself Back as if you book flights or hotels through the Chase Ultimate Rewards travel portal: 1.25 cents each if you hold the Chase Sapphire Preferred Card and 1.5 cents each if you hold the Chase Sapphire Reserve.

But that all changed with the start of 2023. Chase gutted the Pay Yourself Back benefit by removing Airbnb and slashing the valuable redemption rates.

We'll highlight how Chase Pay Yourself Back works and everything you need to know.

Related reading: Chase Ultimate Rewards: A Guide to Earning & Burning in 2023 and Beyond

How Does Chase Pay Yourself Back Work?

Instead of using your Chase Ultimate Rewards points through the Chase Travel Portal or sending them to one of the dozen-plus Chase transfer partners, you're able to use them to cover purchases on a set of purchase categories that rotate quarterly.

When it first came out nearly three years ago, Sapphire Preferred and Reserve cardholders could use points for redemptions at hardware stores, restaurants, and grocery stores – places where cardholders were spending money when travel was largely off the table. Over the last two-plus years, Chase has rotated these categories.

But what made Pay Yourself Back so valuable is that your points were worth the same amount that they were through the Chase travel portal: You'd get 1.25 cents each with the Sapphire Preferred card and 1.5 cents each with the Sapphire Reserve.

So how do you redeem your points? First, you need to do is make a purchase in one of the eligible categories.

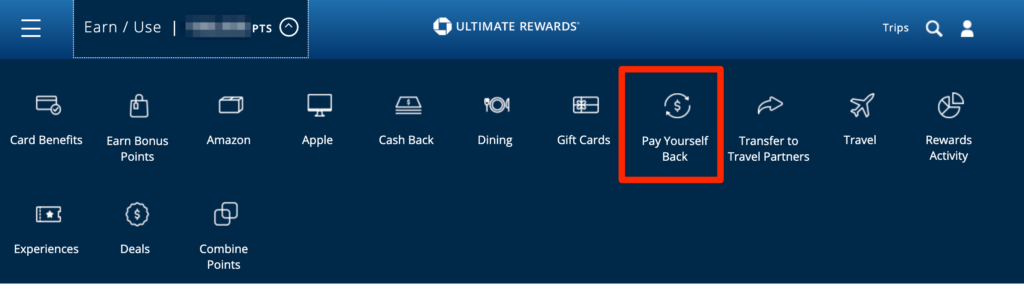

Once that purchase posts to your card account, you can simply log into your Chase Ultimate Rewards account on desktop or through the Chase mobile app and select “Pay Yourself Back” from the drop-down menu.

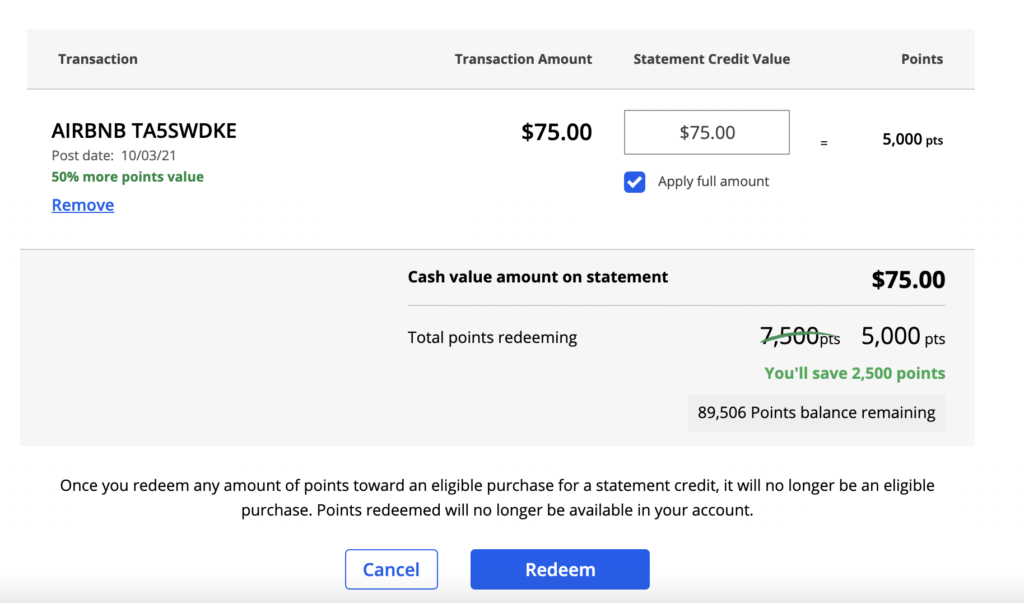

From there, you will be able to select from recent eligible transactions up to 90 days prior to the purchase and choose to redeem points for all – or just a portion – of the purchase.

Since I hold the Chase Sapphire Reserve®, my points are worth 1,25 cents each. If I held the Chase Sapphire Preferred® Card, my redemption value would be 1 cent for each point.

After selecting a transaction, you'll be given the option to use points to cover all or part of the transaction. Once you make that decision, just hit “Confirm & Submit.”

And just like that, your points will be deducted from your balance of Chase Ultimate Rewards points and you should see a statement credit on your card account within a few days to cover the charge.

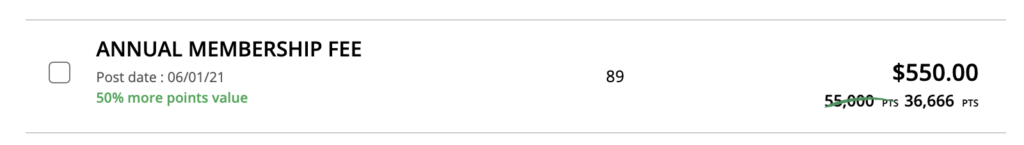

You can even use points to cover the annual fee if you have the Sapphire Reserve. Points will be worth 1.25 cents each for that redemption.

What Chase Credit Cards are Eligible for Chase Pay Yourself Back?

When Chase first introduced Pay Yourself Back in May 2020, it was only available to Sapphire Preferred and Sapphire Reserve cardholders. Starting in October 2020, both the Chase Freedom Flex and Chase Freedom Unlimited added the option to use Pay Yourself Back at one of the 12 select charities listed below. These are valid through 12/31/23.

- American Red Cross

- Equal Justice Initiative

- Feeding America

- Habitat for Humanity

- International Medical Corporation

- Leadership Education Fund

- NAACP Legal Defense and Education Fund

- National Urban League

- Thurgood Marshall College Fund

- United Negro College Fund

- United Way

- World Central Kitchen

Additionally, the Chase Ink Business Preferred Credit Card, the Ink Business Cash, and Ink Business Unlimited were added to Pay Yourself Back, and you are able to use them for internet, cable & phone services, and the 12 select charities listed above through March 31, 2023.

With Ink Cash and Unlimited, internet, cable, and phone services will be worth 1.1 cents each through Pay Yourself Back.

Here's a full breakdown of eligible Chase cards, categories, and current expiration dates for Chase Pay Yourself Back.

| Credit Card | Eligible Categories | Current Ending Date |

|---|---|---|

| Chase Sapphire Preferred® Card | Gas Stations, Grocery Stores | Mar. 31, 2023 |

| Chase Sapphire Reserve® | Gas Stations, Grocery Stores, Card Annual Fee | Mar. 31, 2023 |

| Chase Freedom Flex℠ | Select Charities | Dec. 31, 2023 |

| Chase Freedom Unlimited® | Select Charities | Dec. 31, 2023 |

| Chase Ink Business Preferred℠ Credit Card | Internet, Cable, & Phone Services, and Select Charities | March, 31, 2023 (Dec. 31, 2023, for charity option) |

| Chase Ink Business Unlimited℠ Credit Card | Internet, Cable, & Phone Services, and Select Charities | March, 31, 2023 (Dec. 31, 2023, for charity option) |

| Chase Ink Business Cash℠ Credit Card | Internet, Cable, & Phone Services, and Select Charities | March, 31, 2023 (Dec. 31, 2023, for charity option) |

| Chase Ink Cash | Internet, Cable, & Phone Services, and Select Charities | March, 31, 2023 (Dec. 31, 2023, for charity option) |

How to Earn Chase Ultimate Rewards Points

There are many methods and credit cards that will help you earn Ultimate Rewards points. But in order to take full advantage of the Chase Pay Yourself Back benefit, you'll want to hold either the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

To start, the Chase Sapphire Preferred® Card is one of our favorites. This Chase card earns 3x points per dollar spent on dining out at restaurants, 3x points per dollar spent on online grocery purchases (excluding Target, Walmart, and wholesale clubs), and 3x points per dollar spent on select streaming services.

You'll also earn 2x points per dollar spent on travel purchases, and up to $50 in statement credits each account anniversary year for hotel stays purchased through Chase Ultimate Rewards.

You'll also earn 60,000 Chase Ultimate Rewards Points after spending $4,000 in the first three months of card membership.

And considering the card has only a $95 annual fee, you can come out way ahead on that cost. You'll get at least $750 to use on travel.

In our minds, there's no better travel credit card for beginners.

Click Here to learn more about the Chase Sapphire Preferred Card.

How to Earn Points with the Chase Sapphire Reserve

Then there is the Chase Sapphire Reserve®, the premium version of the Sapphire Preferred Card with an annual fee of $550 each year. But with that higher annual fee, you get more premium travel benefits. You'll also earn 3x points per dollar spent on dining out at restaurants and travel expenses.

After opening the card and spending $4,000 in the first three months of card membership, you can earn 60,000 Chase Ultimate Rewards Points.

But since the points redeem at 1.5 cents each, these points will be worth at least $1,200 towards travel, or via the Pay Yourself Back benefit.

Click Here to learn more about the Chase Sapphire Reserve

Is Chase Pay Yourself Back Worth It?

These are travel credit cards, so the main reason to hold a Chase Sapphire Preferred or Chase Sapphire Reserve card is for the travel benefits. Pay Yourself Back emerged at a time when almost all travel was on hold – Chase needed a way to keep cardmembers happy and engaged while stuck at home.

With Chase gutting this benefit at the start of 2023, your points will simply be worth more when you use them towards travel. And you can potentially get even more value by leveraging Chase transfer partners and sending your points to hotels and airlines, of course.

At the end of the day, this benefit simply gives you more flexibility to use your points. That flexibility is the biggest reason we think Chase Ultimate Rewards points are so valuable, but your points will be better used toward travel expenses.

Bottom Line About Chase's Pay Yourself Back

While there may be flashier ways to put your Chase points to use, this is a great way to redeem points – especially for Airbnb stays. And it just underscores the flexibility that makes Chase's points so valuable.

Thinking about applying for the Sapphire Preferred but have the Ink Preferred. Besides CIP being a business card are these cards identical?

Hi Tim,

The cards are similar, but not identical.

Both earn Chase Ultimate Rewards points which redeem the same way and have a $95 annual fee. But the categories in which you earn bonus points are different. The Sapphire Preferred earns 2x per dollar spent on dining and travel where your Ink Preferred earns 3x points on all travel; shipping costs, internet, phone, and cable service.

Chase allows you to have both cards so there is no issue there. And if you have both of them, you can combine the points into 1 account.

Can I phone Chase or Ultimate Rewards to get my grocery bills and restaurant bills covered by my Ultimate Rewards points. I don’t do online for my cards.

I’m sure it’s possible but it only takes a few clicks to do it online if you want to get it set up.

Hi Nick,

I used the Pay Yourself Back feature for some grocery charges this past month on my CS Reserve. Not only did they issue the credits, I also got 2 grocery entries used as part of my $300 Travel Credit without doing anything! This works for me! When I was online I noticed that CSR was offering a 20% bonus on using points for Apple products so I used them to finally get a pair of AirPods! Only paid $86. Win, Win, Win. Thanks for always tracking these great offers, I don’t always pay as close attention as I should.

Thanks for the message, Peggy. Glad to hear you are finding value in it like we are. It is a great deal.

My annual fee hit today and was surprised that this amount was also a Pay Yourself Back category. Haven’t decided yet if I will use my points for it.

Hi Nick,

I already have a Chase Sapphire Preferred and love it. Just used Pay Yourself Back for groceries and gas to pay my monthly bill. I’m eligible for a Chase Freedom Unlimited. After the initial $200 cash back and 0% for 15 months offer and no annual fee, do you see any advantage of keeping this card?

Hi Kerry, absolutely keep it. You’ll earn more points on most transactions than you will with just your Sapphire card. Since you’ll earn 1.5% back (1.5x points), use it for transactions that would otherwise earn only 1 point with your Sapphire Preferred.