After a great Thrifty Traveler team retreat in Asheville, North Carolina – cue the breweries, barbecue, touring the Biltmore Estate, and some hiking – earlier this fall, we were all ready to get home. But my trip wasn't over yet: A mechanical delay led to a missed connection and an extra night away from home.

That meant I got to experience firsthand how Chase's trip delay reimbursement coverage actually works. And I'm here to tell you it's an easy benefit to use – one that's well worth charging your flights to a card with outstanding travel protections like the *chase sapphire preferred*, *chase sapphire reserve*, or even the *chase ink preferred*.

What was supposed to be a quick connection in Dallas-Fort Worth (DFW) en route home turned into an unplanned overnight stay. While American Airlines was quick to rebook me and proactively sent me an email with links for food and hotel vouchers, it was clear after a quick look at the list of eligible hotels that I'd be venturing out on my own to find lodging for the evening.

And that was possible thanks to Chase's trip delay reimbursement. I was able to head straight to the Grand Hyatt DFW – attached to the terminal – and get a good night's rest before my flight the next morning … without worrying about the cost.

Here's my experience using Chase's trip delay insurance – and how it can help you.

Read more: The 4 Best Credit Cards for Travel Insurance

What is Trip Delay Insurance?

Trip delay insurance is a benefit that's offered on several of the best travel rewards credit cards and you might be surprised to learn that it doesn't even require you to have a card with a sky-high annual fee. Chase includes this benefit on both the *chase sapphire preferred* and the *chase ink preferred* – two cards with annual fees under $100 each year. You'll also find this coverage on the more premium *chase sapphire reserve* as well.

As long as you booked your flights with a Sapphire Preferred, Ink Preferred, or the Ultimate Rewards points the card earns, Chase will reimburse you for expenses like lodging, food, and toiletries – up to $500 per ticket – when your flight is delayed by 12 hours or more – or requires an overnight stay. This applies to not only the main cardholder but also a spouse, and any dependent children under the age of 26 booked on the same itinerary.

If you book a trip with your Sapphire Reserve Card and your common carrier (airline, bus, cruise ship, or train) is delayed for a covered reason for six hours or more, or overnight, you can receive reimbursement up to $500 per ticket, per trip. That's half the amount of time as the Sapphire Preferred and Ink Preferred's 12-hour requirement!

You'll find similar trip delay coverage on other top travel cards like the *venture x* and the *amex platinum*.

No matter which card you're using for trip delay coverage, it's a good idea to put all the expenses related to your claim on that same card. However, if you don't have the right card with your or are unable to use it for some reason, you should still be eligible for reimbursement per Chase's benefit terms.

Related reading: Chase Sapphire Preferred vs Chase Sapphire Reserve

How to File a Trip Delay Reimbursement Claim

Even though you have up to 60 days to file your claim, I wanted to get mine going as soon as possible so I called the number on the back of my card. After following the automated prompts to get me to the right department, I was informed that I could continue by phone or start the claim online myself at eclaimsline.com, a third-party claims center powered by Allianz Travel Insurance that handles Chase's benefits. Knowing that I'd eventually need to upload documentation for my claim anyway, I opted to end the call and do it all online myself.

Landing on the Claims Center homepage you're given two choices: Start a claim or find an existing claim. In my case, I was starting fresh so I chose the “Start a Claim” button. When I returned to this page throughout the process for status updates and to upload additional documentation, I was able to easily access my claim with the “Find Existing Claim” button.

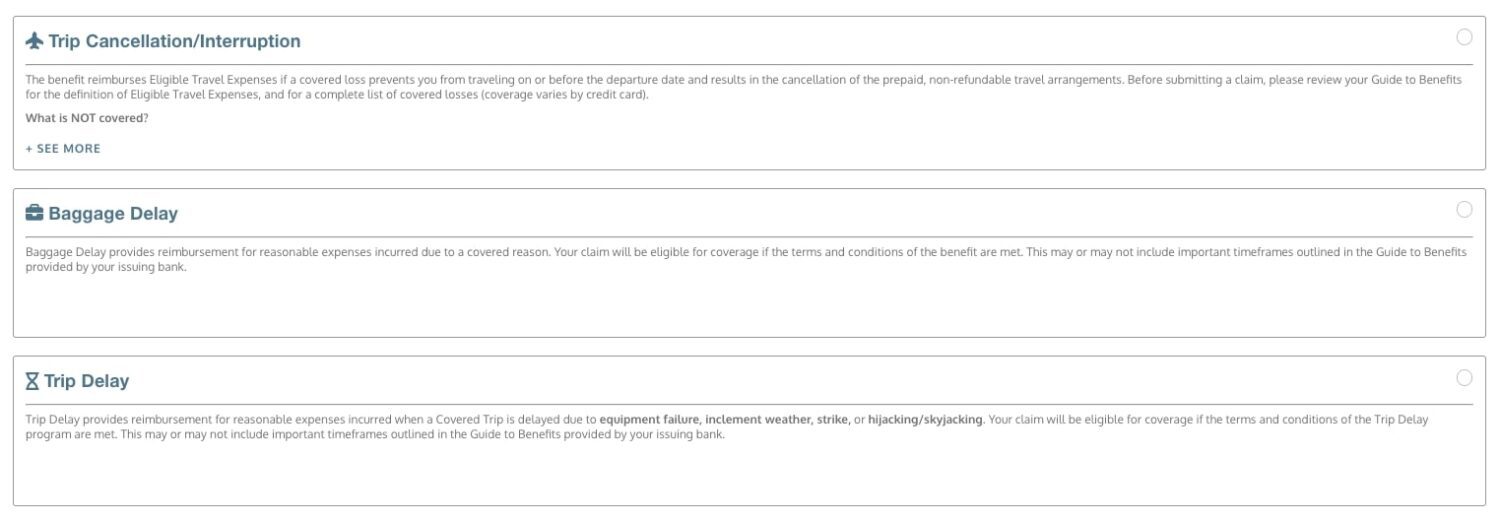

After putting in my credit card number and name to verify benefits, I was presented with several different claim types. Since I was filing for “Trip Delay,” that's the option I chose.

This is the same system that Chase uses to administer all of its travel insurance so if I had instead needed to use Chase's primary rental car coverage or file for trip cancellation, lost or delayed luggage reimbursement, or a travel-related accident, I could have done that here as well.

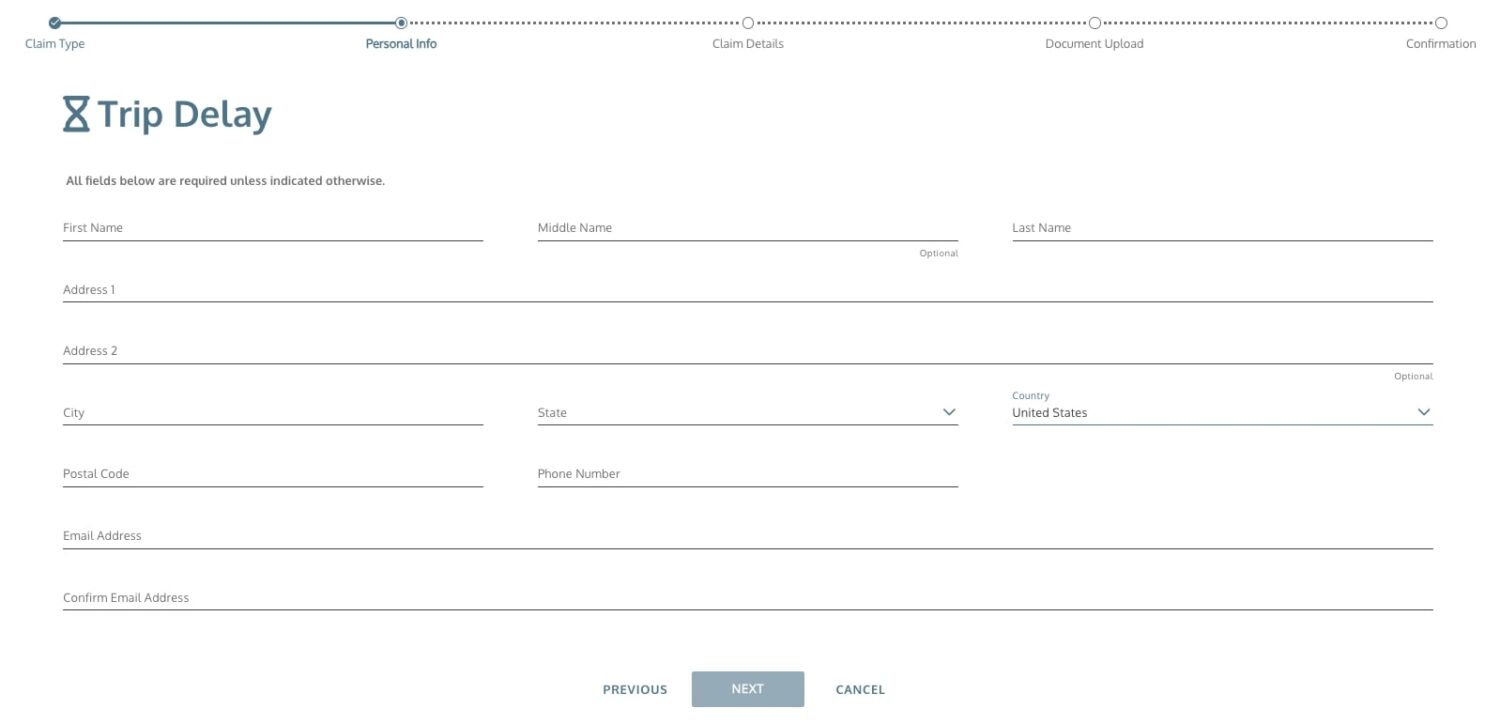

The next step was to fill in my personal information. This should have been pretty straightforward but since I was filing a claim on a company card, I didn't know for sure whether or not to use my name, or my employer's. It turns out that the name you put in this field is who the payment will be made out to when the claim is approved so if it needs to be directed to your employer like mine did, make sure you put their info in here instead of your own.

Next, I filled in my name as the “traveler” and my relationship to the cardholder as “employee.” For the remaining fields, you'll be asked when you initially purchased your airfare, your roundtrip travel dates, and the total amount you're claiming for reimbursement. This includes all of your expenses related to the delay, including lodging, food, and any toiletries that you purchased.

Just keep in mind that the max reimbursement is $500 per passenger so if you're claiming more than that, you shouldn't expect to get the full amount back.

You'll be asked to upload documentation for your claim. This includes receipts for your meals, hotel, and any other expenses, so be sure to hang on to these. You'll also need to include your original itinerary and proof of your delay. In my case, I uploaded the confirmation e-mail I received at booking, and a screenshot of my original boarding pass, as well as my new boarding pass for my rebooked flight.

This didn't prove to be enough documentation or explain why my original flight was delayed, though. Since they were unable to independently verify the reason for the delay through a site like Flight Aware, Allianz reached out to me by both phone and e-mail to let me know what else was needed.

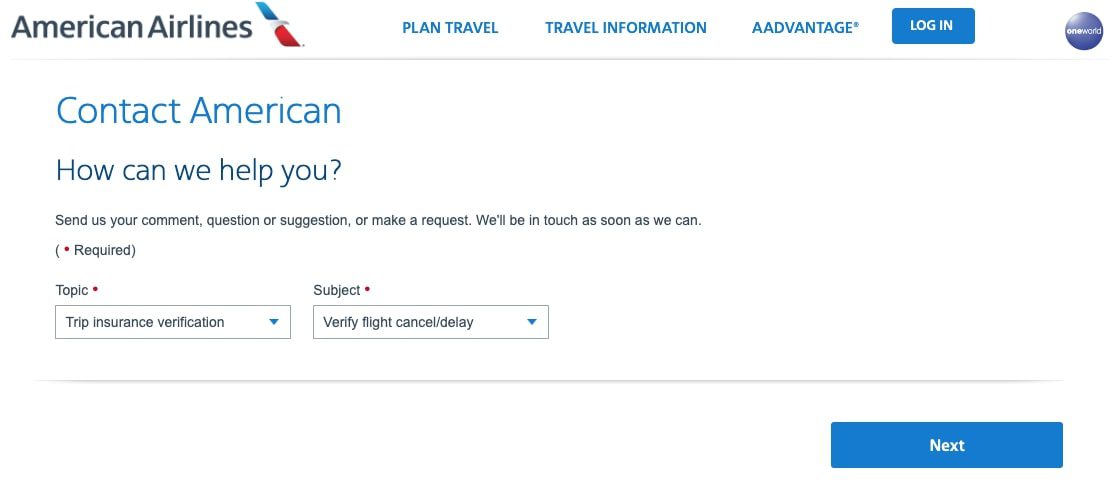

In the end, I had to obtain a statement from the airline (American Airlines, in my case) stating the reason for the delay. I was able to easily request “trip insurance verification” online by filling out a form on American Airline's website. While I can't speak to other carriers, they likely have a similar process through the “Contact Us” page on their sites as well.

After completing the online form, AA emailed me a statement that included the reason for my delay, which I quickly forwarded. Approximately a week later, I received another email letting me know that my claim had been approved and I was able to go in and request my preferred payment method.

Learn from my mistake: Make sure you have proper proof of your trip delay from the carrier before filing your claim. Doing so would have saved me a week's worth of back and forth.

How to Get Paid

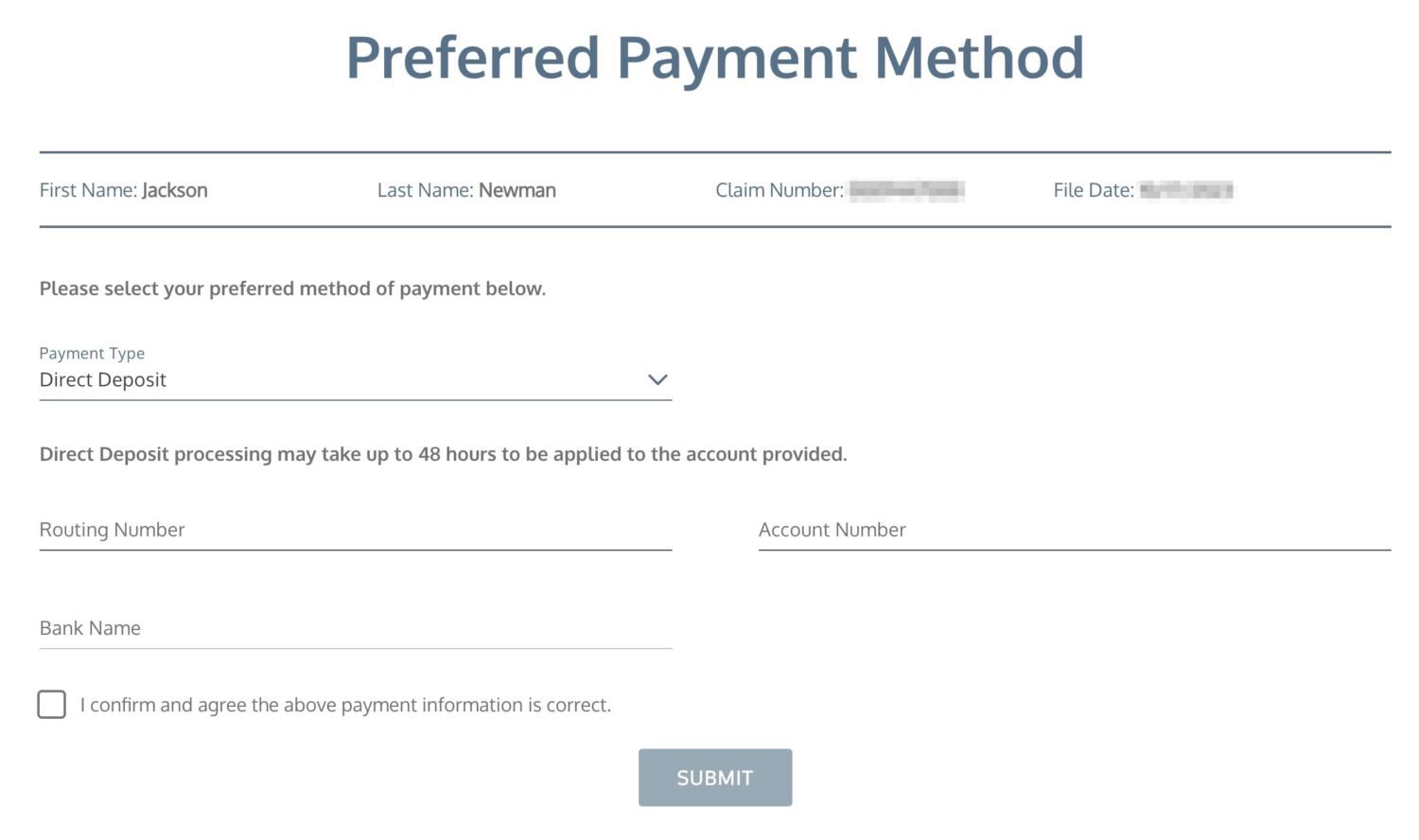

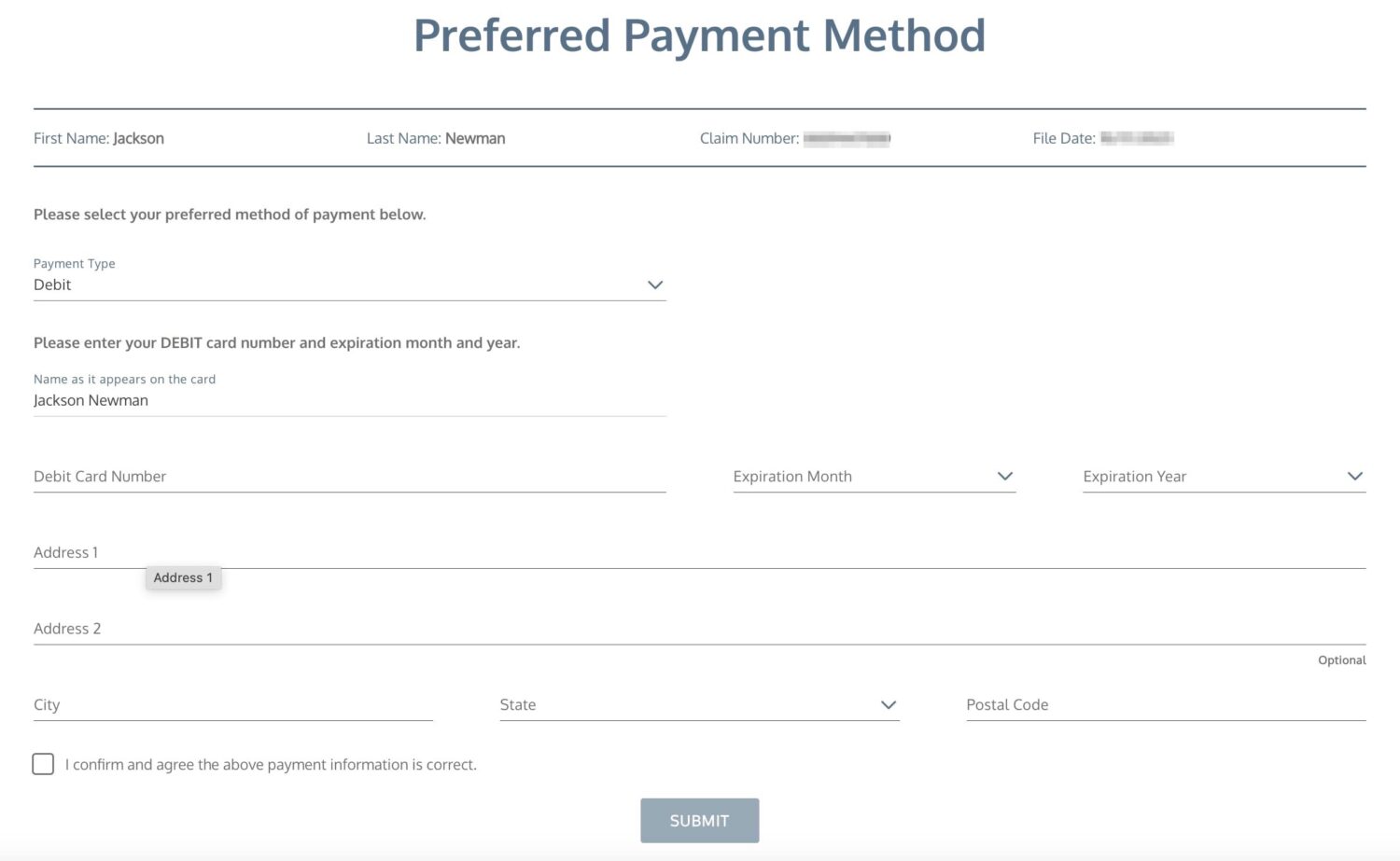

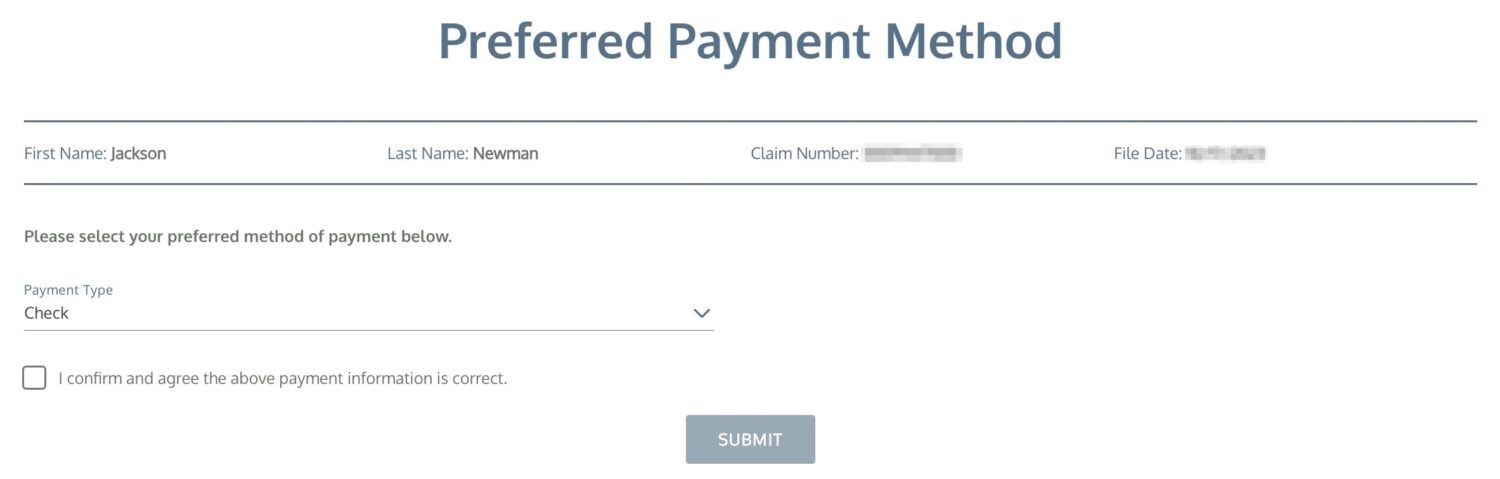

After getting an email letting me know that the claim was approved, I was prompted to log back in and select my preferred payment method. It's important to do so quickly as the link they send is only good for 48 hours. If you don't, it will send a check to the address associated with the claim.

The options for accepting your payment are direct deposit, check, or an electronic transfer via your debit card. If you opt for direct deposit or electronic transfer, you'll need to have your account number and routing number handy – or your debit card number, if you go that route instead.

Since I wasn't the one collecting the reimbursement – it was going to my employer – I opted to have the check mailed instead of going with the quicker, direct deposit or electronic transfer reimbursement methods.

After choosing my desired reimbursement method, it took approximately a week for the check to arrive. All told it was a relatively quick and painless process – much faster than I had initially feared. In the end, this benefit covered the entirety of my $423 last-minute hotel stay plus the cost of my meals.

Trip Delay Reimbursement FAQs

Do I Need to Use the Same Card For My Reimbursable Expenses?

No, Chase's terms don't require you to use the covered card for your reimbursable expenses. Still, it's a good idea to do so if you can – and since these Chase cards provide bonus points for travel expenses there's even more incentive to do so.

In rare instances, you'll be asked to see the card used to book your flights at an airline check-in desk as well, which is another good reason to have it with you when you travel.

What Documentation Do I Need to Provide?

The most important piece of documentation is proof of your delay. I tried uploading copies of my boarding passes and this (understandably) wasn't enough. Getting a statement from the airline (or cruise, bus, train, etc.) that verifies your delay should be your first step before even beginning the claim process.

You'll also want to include receipts for all the expenses that you're requesting reimbursement for. I'm notorious for throwing away receipts (or not taking them at all) so if that sounds like you – it's important to remember to hold on to them in these situations. You might be able to get away with uploading a copy of your credit card statement showing the purchases that you're requesting reimbursement for if you don't have a receipt, but I wouldn't count on it.

How Long Does it Take to Be Reimbursed?

Anyone who's filed an insurance claim knows that it's typically a long painful process. Maybe I just went into this expecting the worst but I have to say, I was pleasantly surprised by just how quick it was.

Four days after I filed the claim online I was contacted letting me know that they needed additional proof of delay to process my claim. After a quick back and forth with my airline, I was able to get verification of my delay and get it attached to my claim.

Six days later, I received notice that my claim was approved and I could request payment. It took another four days after that for the payment to be authorized and about seven days for the check to actually arrive in the mail. All told, it took a grand total of three weeks.

Had I uploaded proper proof of my delay at the start and opted for direct deposit or electronic transfer as my reimbursement method, I'm confident that the whole process would have been completed in 10-14 days instead of the nearly three weeks it took me.

Bottom Line

After spilling plenty of ink writing about the outstanding travel protections that come with Chase's top travel cards, I finally got a chance to test it out for myself. I'm happy to report that the trip delay insurance benefit on my company Chase Ink Preferred Card worked just as it should and all things considered, the process was easier – and faster – than expected.

Situations like this are why we recommend always booking your travel with a card that carries additional travel protections, so you're not on the hook for extra expenses if the unexpected happens.

Two thing to note:

You do not need to use the credit card as the insurance to get reimbursed. I’ve done 3 claims with Chase in the past year, most recently a month ago. All of them were approved, and none of the charges were paid using the card I was claiming benefits from (in my case, the Chase Ritz Carlton card). I don’t think it’s in the terms that you need to pay the reimbursable charges, just the initial travel.

If your claim is with United, expect a VERY long wait to get your proof of delay notice. In my case it took over 2 months, and when it did come, they didn’t provide correct information. My flight was delayed 15 minutes at departure, and over an hour on the ground at arrival (gates were congested). It was the latter that caused a misconnect and overnight stay, but they only supplied the information for why we left the gate 15 minutes late. I had to call Chase and explain the situation after I uploaded all the documentation, they sent the notes to an adjustor who approved the claim without having to go back to United.

That’s good to know! I just double-checked Chase’s Guide to Benefits and you’re correct – I don’t see any mention of needing to use the same card for your reimbursable expenses. The story has been updated accordingly.

Also, good to know that it can be a bit of a pain with some carriers. My experience getting proof from AA couldn’t have been any easier … once I knew where to go.

Does this only apply to flights that you book with Chase rewards points, or does it work with flights that are charged to the card? Such as, if it is booked directly with the airline and paid with the Chase card?